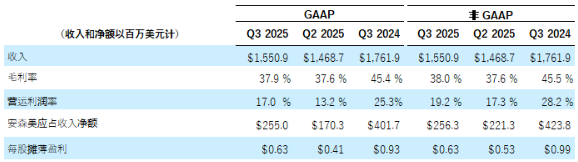

安森美(onsemi,美国纳斯达克股票代号:ON)公布其2025年第三季度业绩,要点如下:

- 第三季度收入为 15.509亿美元

- 第三季度公认会计原则(以下简称“GAAP”) 和 非GAAP 毛利率分别为 37.9%和38.0%

- 第三季度GAAP 营业利润率和非GAAP营业利润率分别为 17.0%和19.2%

- 第三季度GAAP 每股摊薄收益和非GAAP 每股摊薄收益均为 0.63美元

- 运营现金流为4.187亿美元

- 自由现金流为3.724亿美元,同比增长22%,占收入的24%

- 截至目前,年度回购股份金额为9.25亿美元,约占自由现金流的100%

“我们第三季度业绩超预期,彰显了公司战略的有效性和业务模式的强大韧性。我们看到核心市场持续企稳迹象,在人工智能领域也实现了积极增长,”安森美总裁兼CEO Hassane El-Khoury说,“随着能效成为下一代汽车、工业及 AI 平台的关键要求,我们正持续扩展产品组合,提供系统级价值,助力客户以更低能耗实现更优性能。”

下表概列2025年第三季度与可比较时期的部分财务业绩(未经审计):

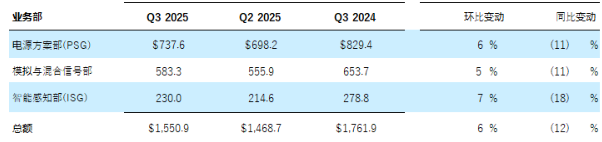

收入汇总

(百万美元)

(未经审计)

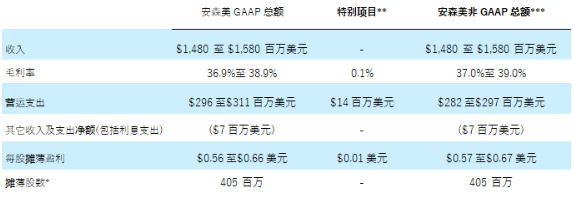

2025年第四季度展望

下表概列安森美预计2025年第四季度的GAAP及非GAAP展望:

* Diluted shares outstanding can vary as a result of, among other things, the vesting of restricted stock units, the incremental dilutive shares from the convertible notes, and the repurchase or the issuance of stock or convertible notes or the sale of treasury shares. In periods when the quarterly average stock price per share exceeds $52.97 for the 0% Notes, and $103.87 for the 0.50% Notes, the non-GAAP diluted share count and non-GAAP net income per share include the anti-dilutive impact of the hedge transactions entered concurrently with the 0% Notes, and the 0.50% Notes, respectively. At an average stock price per share between $52.97 and $74.34 for the 0% Notes, and $103.87 and $156.78 for the 0.50% Notes, the hedging activity offsets the potentially dilutive effect of the 0% Notes, and the 0.50% Notes, respectively. In periods when the quarterly average stock price exceeds $74.34 for the 0% Notes, and $156.78 for the 0.50% Notes, the dilutive impact of the warrants issued concurrently with such notes is included in the diluted shares outstanding. GAAP and non-GAAP diluted share counts are based on either the previous quarter's average stock price or the stock price as of the last day of the previous quarter, whichever is higher.

** Special items may include: amortization of acquisition-related intangibles; expensing of appraised inventory fair market value step-up; restructuring-related cost of revenue charges; non-recurring facility costs; in-process research and development expenses; restructuring, asset impairments and other, net; goodwill impairment charges; gains and losses on debt prepayment; actuarial (gains) losses on pension plans and other pension benefits; and certain other special items, as necessary. These special items are out of our control and could change significantly from period to period. As a result, we are not able to reasonably

estimate and separately present the individual impact or probable significance of these special items, and we are similarly unable to provide a reconciliation of the non-GAAP measures. The reconciliation that is unavailable would include a forward-looking income statement, balance sheet and statement of cash flows in accordance with GAAP. For this reason, we use a projected range of the aggregate amount of special items in order to calculate our projected non-GAAP operating expense outlook.

*** We believe these non-GAAP measures provide important supplemental information to investors. We use these measures, together with GAAP measures, for internal managerial purposes and as a means to evaluate period-to-period comparisons. However, we do not, and you should not, rely on non-GAAP financial measures alone as measures of our performance. We believe that non-GAAP financial measures reflect an additional way of viewing aspects of our operations that, when taken together with GAAP results and the reconciliations to corresponding GAAP financial measures that we also provide in our releases, provide a more complete understanding of factors and trends affecting our business. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other companies’ non-GAAP financial measures, even if they have similar names.

电话会议

安森美已于美国东部标准时间 (ET) 2025年 11 月 3日上午 9 时举行金融界电话会议,讨论此次的发布和安森美 2025 年第三季度业绩。英语电话会议已在公司网站http://www.onsemi.cn的“投资者关系”网页作实时广播。实时网上广播大约1小时后在该网站回放,为时30天。

芯耀

芯耀

248

248